In a groundbreaking move shaping the future of fintech and digital payments in the Middle East and North Africa’s (MENA) restaurant industry, leading digital banking and payments company Fawry

Paytech

In March 2021, following new minimum wage legislation, Qatar became a regional leader, promoting financial inclusion that targets low-income workers whose salaries are pegged at QR1,000 ($275USD) each month.

Mobile payments have seen significant growth in the Middle East in recent years. This trend can be attributed to several factors, including the widespread adoption of smartphones, the availability

Mashreq Bank, based in the United Arab Emirates, has established a strategic alliance with Pakistan’s Bank AL Habib that will allow Mashreq to provide free remittance transfer services from

OpenWay proudly announces that its Way4 Card-as-a-Service enabling platform, recently launched in Europe and already recognized as one of the top CaaS technology solutions on the market, is now

The Open Finance Working Group of the MENA Fintech Association (MFTA) has published a new report highlighting the significance of embedded finance in the Middle East and North Africa

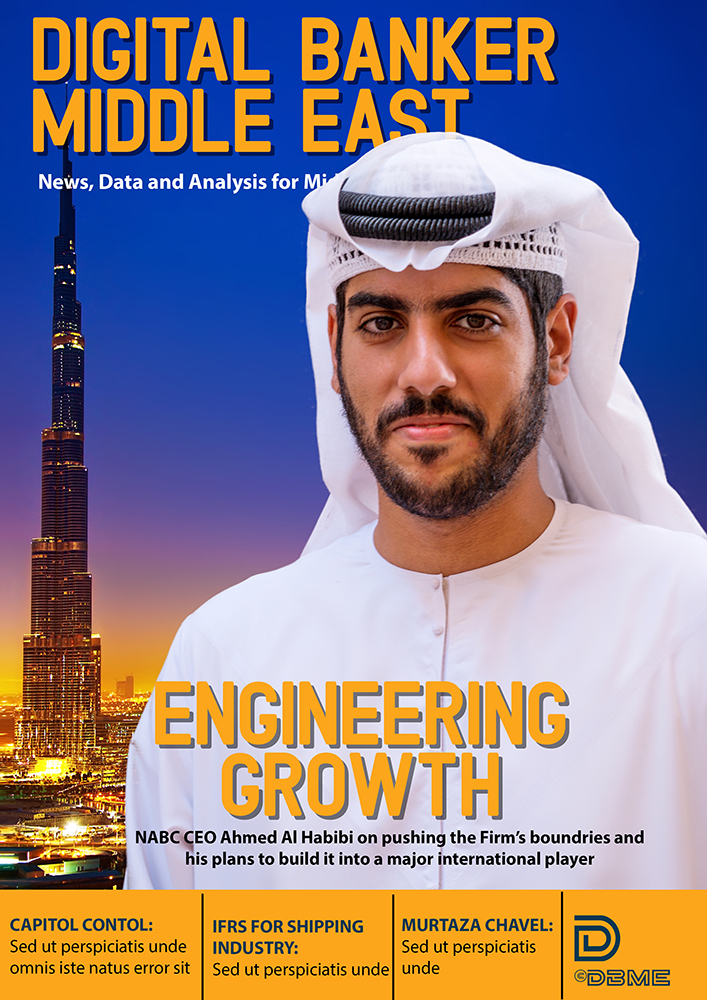

A look into the rise of digital banking and payment systems in the Middle East yields a captivating story. There is a notable change in the financial services landscape

Stripe is expanding its operations into the Middle East with an official launch in the United Arab Emirates (UAE). With the opening of its new office within the Dubai

Paymentology, a FinTech solutions provider based in the United Kingdom, is reinforcing its operations in the Middle East to offer more support for the financial services sector in the